We, Chhapia Financial Management Pvt. Ltd., believe in Quality at the core of all our deliverables.

We, Chhapia Financial Management Pvt. Ltd., believe in Quality at the core of all our deliverables.

In the 75th year of India’s Independence, the world has recognized the Indian economy as a ‘bright star’. India’s current year’s economic growth is estimated to be at 7 per cent. It is notable that this is the Highest rate, among all the major economies of the world.

Introduction

The major motive of this year’s budget has been a dream of a prosperous and an inclusive India. The India, in which the fruits of development reach all the regions and citizens, especially the youth, women, farmers, OBCs, Scheduled Castes and Scheduled Tribes.

The Budget for 2023-24 kept its focus on expanding Capex showing that the Modi government’s priorities are building roads, highways, and railway lines.

The FM stuck to the fiscal deficit roadmap in the Budget with a target of 5.9% in FY 24 and adhering to the target for the current year. This proves to be a positive stance for India, as a bloated Deficit would have raised concerns as to how the Government would have raised the required funding.

The budget has been presented in the backdrop of a strong recovery in the Indian economy after being battered by Covid, recessionary headwinds for major global economies in 2023, and a turbulent global geo-political environment.

The budget recognises and acknowledges the emergence of the Indian economy as an oasis in the economically challenged global economic environment and the world is looking upon India to step up its role as the fastest-growing major economy. The government has taken a pragmatic approach towards this ambitious pursuit.

The FM has focused on reinvigorating economic growth, yet done that with a long-term sustainable approach, avoiding falling prey to short term impulses, given that it was supposedly an election budget.

Message from Our Leader

“This is a multifaceted budget reaching out to majority of the problems faced by the Global Economies. Solving which will put India on the path to becoming the world leader.” – Kiren Chhapia.

The FM has provided for INR 10 Lakh Crores for Capital Expedniture in FY 24, which is an increase of approximately 33 Percent than the last year, and almost four times as compared to FY 16 Budget. This is going to prove to be the strong foundation for helping the growth momentum of the country in the upcoming years.

At the same time, relief has also been provided for the most vulnerable sections by extending the and further allocating more funds to various schemes to improve the quality of life of the weaker sections of the country.

Economic Indicators

1. GDP – GDP growth expanded by 8.7 percent in FY22; Projected GDP growth for FY23 is 7.0 percent. The GDP Growth is resilient, unaffected by Global Disturbances.

2. Repo Rate – RBI hiked the repo rate for the fifth time in the past year by 225 bps to 6.25 percent. The central bank will continue to focus on withdrawal of accommodation of liquidity.

3. Fiscal Deficit – Fiscal deficit is estimated to be at 6.4 percent in FY23 compared with 6.7 percent in FY22; The deficit is budgeted to be at 5.9 percent in FY24.

4. Consumer Price Index – CPI averaged at 6.8 percent in April− December 2022, driven by food inflation and high fuel prices. Core prices edged to 6.1 percent during this period.

5. Forex Trades – Net FDI inflows amounted to US$20.0 billion for H1 FY23, 1.5 percent lower than those for H1 FY22. Merchandise exports expanded by 9.1 percent to US$332.8 billion in April−December 2022.

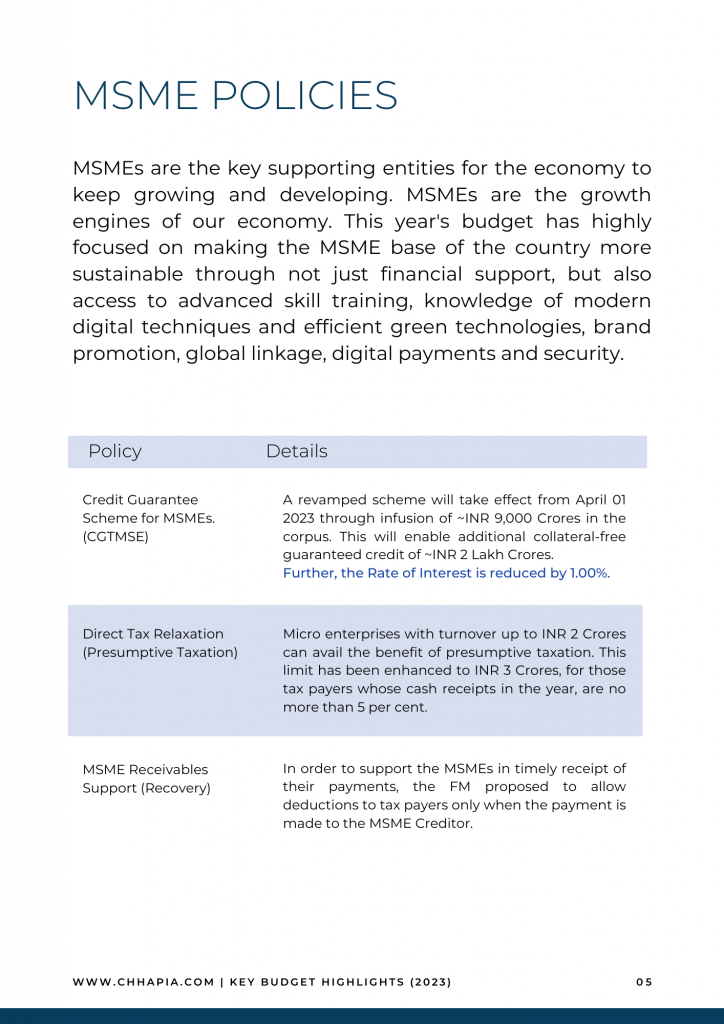

MSME Policies

MSMEs are the key supporting entities for the economy to keep growing and developing. MSMEs are the growth engines of our economy. This year’s budget has highly focused on making the MSME base of the country more sustainable through not just financial support, but also access to advanced skill training, knowledge of modern digital techniques and efficient green technologies, brand promotion, global linkage, digital payments and security.

1. Credit Guarantee Scheme for MSMEs (CGTMSE) – A revamped scheme will take effect from April 01 2023 through infusion of ~INR 9,000 Crores in the corpus. This will enable additional collateral-free guaranteed credit of ~INR 2 Lakh Crores.

Further, the Rate of Interest is reduced by 1.00%.

2. Direct Tax Relaxation (Presumptive Taxation) – Micro enterprises with turnover up to INR 2 Crores can avail the benefit of presumptive taxation. This limit has been enhanced to INR 3 Crores, for those tax payers whose cash receipts in the year, are no more than 5 per cent.

3. MSME Receivable Support (Recovery) – In order to support the MSMEs in timely receipt of their payments, the FM proposed to allow deductions to tax payers only when the payment is made to the MSME Creditor.

Policy Announcements

1. Skilling & Education – New-age skill sets to be imparted through PM Kaushal Vikas Yojana 4.0 and launch of a unified Skill India Digital Platform; and 30 Skill India International centres to be set up for widening the skilling ecosystem.

2. Capital Investment – Increased outlay of INR 10 trillion for development projects across sub-sectors and the centre to fund states through grant-in-aid and create finance secretariat for private investment in infrastructure.

3. Entity Digilocker – An Entity DigiLocker will be set up for use by MSMEs, large business and charitable trusts. This will be towards storing and sharing documents online securely.

4. Green Growth – Green Credit Programme to encourage environmentally sustainable actions; launch of PM-PRANAM to incentivise states and UTs to promote alternative fertilisers.

5. Support to State Governments (Infrastructure) – Continuation of the 50-year interest free loan to state governments for one more year to spur investment in infrastructure, with a significantly enhanced outlay of ~INR 1.3 Lakhs Crores.

Taxation Highlights

1. Basic Exemption Limit – Increase in basic exemption limit up to INR 3,00,000 under the new tax regime for individuals and certain taxpayers, along with changes in slab rates.

2. Highest Surcharge – Reduction in the highest surcharge rate from 37 percent to 25 percent for individuals and certain taxpayers under the new tax regime.

3. Tax Rebate – Increase in tax rebate up to 100 percent of tax for resident individuals with income up to INR 7,00,000 under the new tax regime.

4. Eligible Startups – Date of incorporation for eligible start-ups to avail of income-tax benefits extended to 31 March 2024. Benefit of carry-forward of losses for eligible start-ups on change of shareholding extended from seven to 10 years.

5. Investment in Residential Property – Relief from Capital Gains on Investment in New Residential House Property, is now hereby capped at a maximum of INR 10 Crores worth of Investment.

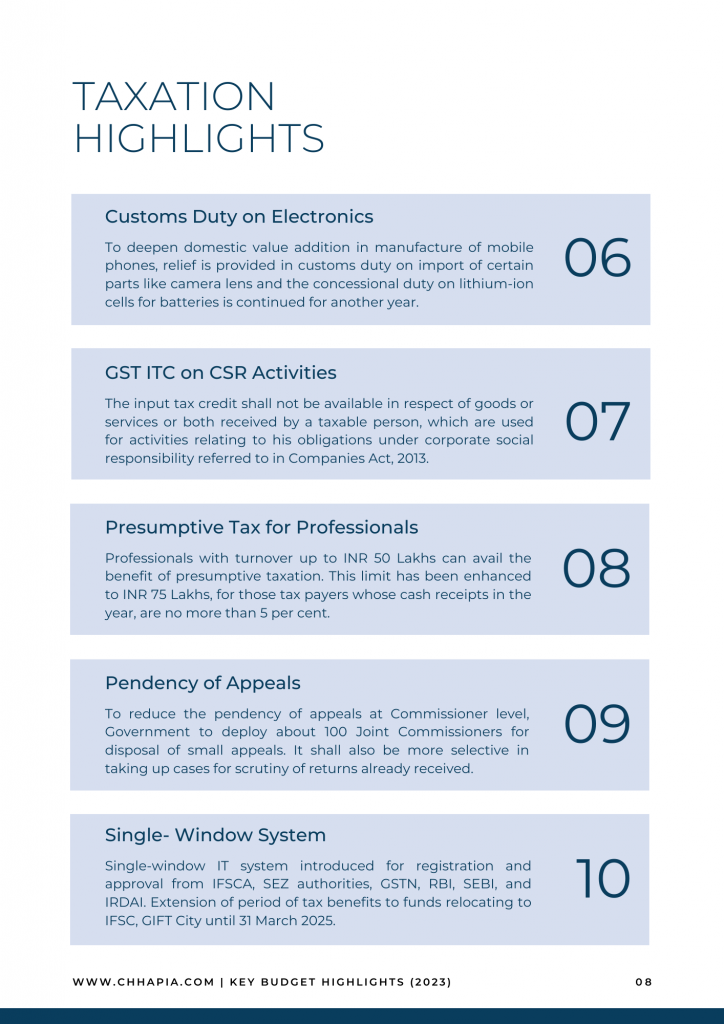

6. Customs Duty on Electronics – To deepen domestic value addition in manufacture of mobile phones, relief is provided in customs duty on import of certain parts like camera lens and the concessional duty on lithium-ion cells for batteries is continued for another year.

7. GST ITC on CSR Activities – The input tax credit shall not be available in respect of goods or services or both received by a taxable person, which are used for activities relating to his obligations under corporate social responsibility referred to in Companies Act, 2013.

8. Presumptive Taxation for Professionals – Professionals with turnover up to INR 50 Lakhs can avail the benefit of presumptive taxation. This limit has been enhanced to INR 75 Lakhs, for those tax payers whose cash receipts in the year, are no more than 5 per cent.

9. Pendency of Appeals – To reduce the pendency of appeals at Commissioner level, Government to deploy about 100 Joint Commissioners for disposal of small appeals. It shall also be more selective in taking up cases for scrutiny of returns already received.

10. Single- Window System – Single-window IT system introduced for registration and approval from IFSCA, SEZ authorities, GSTN, RBI, SEBI, and IRDAI. Extension of period of tax benefits to funds relocating to IFSC, GIFT City until 31 March 2025.

CONCLUSION

The biggest transformation this year is the Focus of the Indian Budget 2023, has shifted from the ‘Next Year’ to the ‘Next Generation’.

Capital Expenditure: Infrastructure if the most important element for a sustainable growth of a country. The government has correctly emphasized the need for increased Capital Expenditures.

Weaker Sections: In order for a country to lead globally, the weaker sections of the society also need to get stronger and sustainable. Hence, the FM has equally prioritised support to the weaker sections.

MSMEs/ Individuals: MSMEs and Individuals are two major pillars of a strong growing economy. This budget has provided for certain crucial support elements to MSMEs and the Individuals for their prosperity.

India is on the path to becoming the Global Leader by end of this Decade!

For more information, feel free to get in touch with us @ info@chhapia.com

Chhapia And Associates, Chartered Accountants

Assurance | Project Finance | Consulting

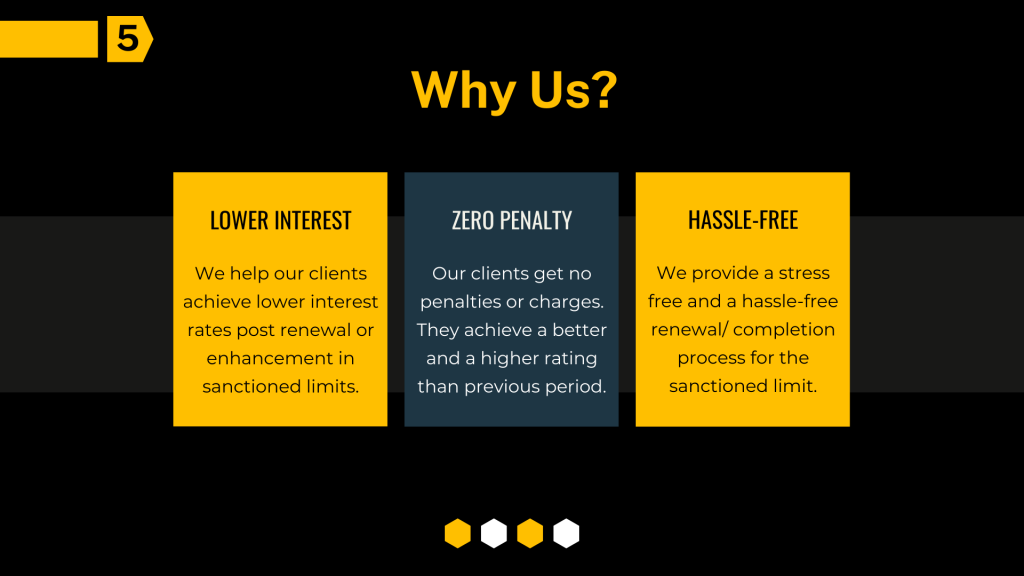

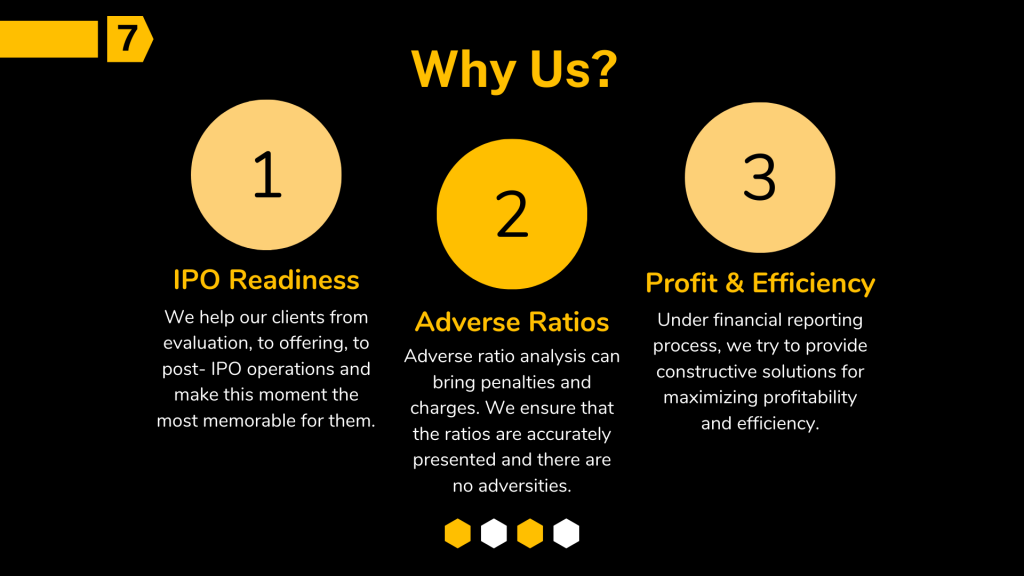

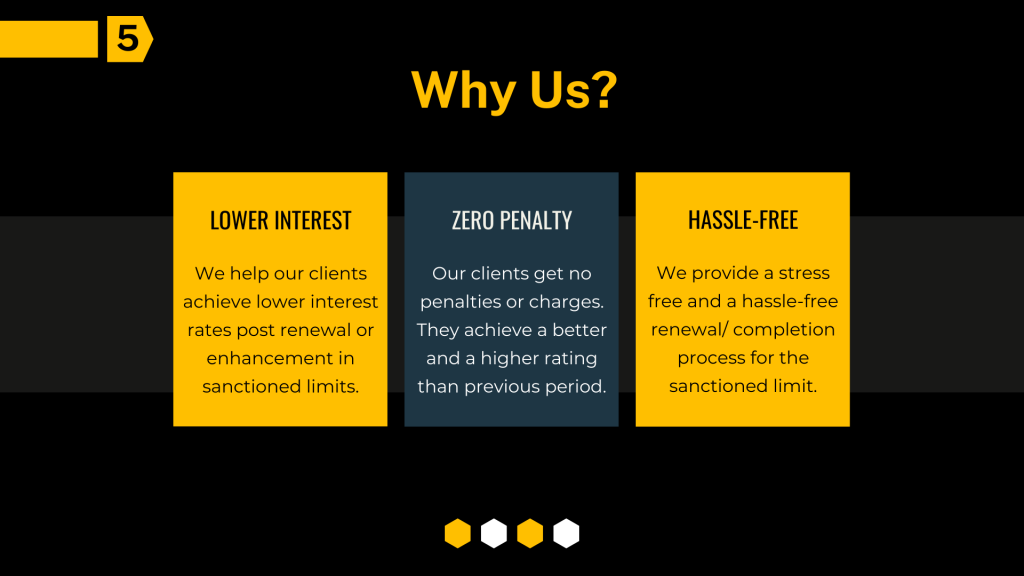

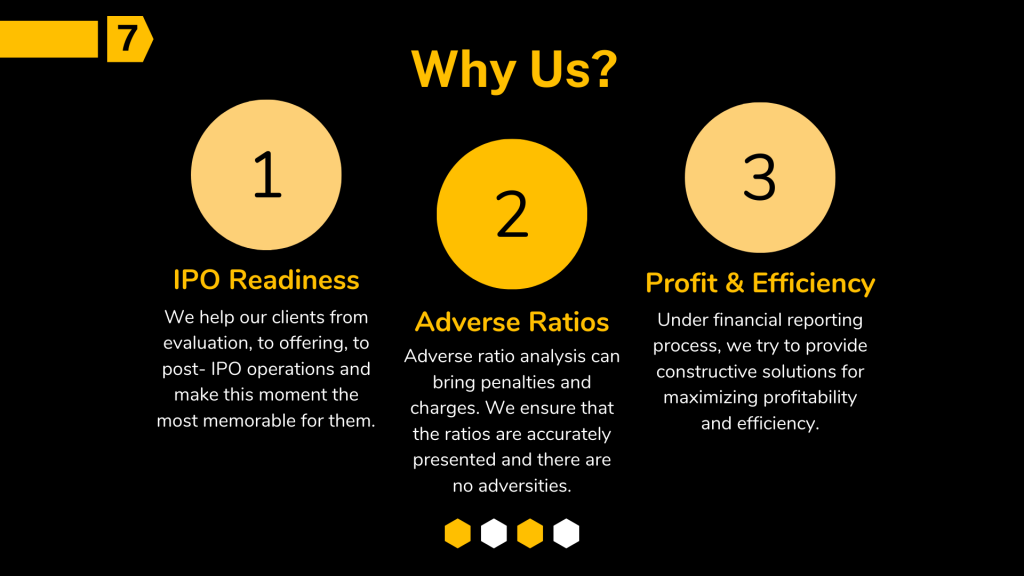

Chhapia and Associates, a firm based out of Rajkot, India. We have been rendering the services in line of Project Finance, Tax Matters, Valuation of Business Equities, Management Consultancy and Designing and Developing Internal Controls System covering a wide range of professional services.

The firm and the people at the firm strongly believe in the professional values. For us each client relationship is like a partnership wherein our success is directly in relation to our clients’ success. We are therefore, committed to provide you with all the solutions you require for the dynamic business environment. All the people at the firm are dedicatedly working towards your personal growth and are committed to provide you close and personal attention.

We at Chhapia, feel proud in letting you know that all the services rendered to you comes after hours of hard work done by the firm inclusive of advanced trainings, technical experiences and the best financial acumen.